News 2020 - archive

News 2019 - archive

News 2018 - archive

News 2017 - archive

News 2016 - archive

News 2015 - archive

News 2014 - archive

News 2013 - archive

News 2012 - archive

News 2011 - archive

News 2010 - archive

News 2009 - archive

The European Parquet Federation (FEP) reports that parquet consumption in Europe has started to decline during the first semester of 2022, reflecting the what it calls “ambient climate of uncertainties”.

According to FEP, the very beginning of the year 2022 was still positive, generally speaking, but parquet consumption quickly started to decline in most of the FEP countries. The decreases were especially significant in France and Germany, while Sweden and Switzerland were still experiencing relatively good conditions during the first part of the year.

FEP explains: “In the given context, with staggering energy bills and inflation, consumers’ confidence is very low, meaning less spendings which are focused on essential needs. If consumers are still investing in buildings, it is more for insulation than interior design. Additionally, renovation works began during the covid time are reaching an end.”

All in all, parquet markets are down in most of the FEP countries for the first semester of 2022 compared to the same period last year. “Those countries which were still experiencing relatively good conditions, are now facing a slowing down of consumption, and are pessimistic for the months and year ahead,” FEP notes. “Availability and/or affordability of raw material wood are still critical.”

A brief per country recap, in the words of the federation, is provided below.

Austria

Austrian consumption of parquet showed a mixed situation during the first semester 2022, with a slightly declining 1st quarter and an overheated 2nd one. Now the situation is deteriorating. Investments in housing are down. Showrooms are empty. Energy costs are staggering. Working shifts will be consequently reduced and uncertainties are present regarding the future.

Benelux

The Netherlands report a decline of parquet consumption in volume of 18% compared to 2021 and an inflation rate of 17%. Energy costs have been multiplied by 3 or 4. The situation for raw material is stable. Belgium is doing a bit better.

France

The French parquet market has started to drop during the 2nd quarter (-20%). And this situation will continue as visits of shops are down by 40%. Massive parquet is the most impacted as the value of wood has strongly increased since April. Scarcity of wood remains an issue and could lead to reduction of production and unemployment.

Germany

The German parquet market was down by 7% during the 1st quarter 2022 and by 12% during the 2nd quarter, giving a decline of 10 to 15% for the 1st semester. Pessimism is present for the rest of the year with an increasing rate of building permit cancellations, hesitation to invest, rising interest rate, skyrocketing energy bills... Consumers are focusing on essential needs and renovation works, started during the covid period, have already been completed. Supply of raw materials is still critical.

Italy

After a good start of the year with an increase of the Italian parquet consumption by 13% compared to 2021, unfortunately, in June, the situation began to deteriorate and this deterioration has accelerated in July. Consumption is now 5 to 6% less than in 2021 but could reach -10% at the end of the year. The performance of the beginning of the year was supported by the significant tax reductions on construction/renovation works but these are now downward revised.

Nordic cluster

The first semester 2022 was good but the Nordic cluster parquet consumption is now slowing down. While the Norwegian parquet market is flat, the Finnish one is slightly declining and the Danish one is more significantly decreasing. Installation costs are increasing, reflecting the general inflation rise.

Spain

The Spanish consumption of parquet was still increasing by 3% during the first part of the current year but demand is now declining fast. Construction of new buildings is decreasing but renovation is still supporting the market. However, inflation and rise of savings are adding to other uncertainties for the future.

Sweden

While the Swedish parquet market is still stable to slightly declining this year (-2 to -5%), it will significantly decrease next year due to a dramatic drop in new building permits (-30%). In addition, renovation works initiated during the covid period are reaching an end, consumers have dedicated money for travelling and now focus on insulation works instead of interior design. DIY e-trade is also remarkably down. Due to currency, imports are more expensive.

Switzerland

The situation is a bit different in Switzerland where inflation is limited to 3% thanks to a strong currency. The Swiss parquet consumption has increased by 12% during the 1st semester 2022 compared to 2021. It is now slowing down but still expected to reach 8 to 10% at the end of the year. Nevertheless, building permits are declining, especially for multifamily houses. White oak is available but at high costs. Energy costs are staggering. The Swiss market is still strong but future trends are negative.

The Brussels based FEP is furthermore launching a new logo which should highlight the wood nature of parquet.

FEP/GFA, October 2022

top

FEP observes that consumption of parquet in Europe in 2021 was higher than in 2019, before the pandemic, and even reached a level not seen since ten years. The federation seems somewhat surprised but says an increase in parquet consumption was expected last year, reflecting a compensation of the impacts of covid-19 and the related measures, such as lockdowns, taken in 2020 in some FEP countries.

After a stable-to-positive year in 2020 (+1,3%), the European consumption of parquet rose by 6,18% in 2021 to a level of 88,155,000 m2, compared to 83,023,000 m2 the year before.

Consumption of parquet has increased on almost all European markets especially during the first semester, when compared to the same period in 2020. During the rest of the year, FEP explains, demand continued to grow but at a slower pace as consumers restarted to dedicate their spendings to areas such as leisure and travels. “Nevertheless, renovation, and adaptation of homes to ‘post-covid-19’ life, remains the driver of the parquet consumption growth.”

As usual, the results show variations from country to country. FEP concludes that countries such as Italy and France, which were not able to offset the loss experienced during the spring 2020 lockdown and reported declines in parquet consumption for the year 2020 as a whole, are showing large increases in parquet consumption in 2021 compared to 2020. Croatia, Romania and Switzerland are also reporting significant increases in parquet consumption while Portugal is focusing more on exports.

On the other hand, FEP continues, countries which totally, or partially, compensated, during the second half of 2020, the bad performance observed in March-April of the same year, generally report lower but still sustained rising rates. This is the case of Scandinavia, Austria and Spain, while the German parquet market stabilizes.

In terms of consumption per country, Germany keeps its first position with 20,45%. Italy at 10,49% and France at 10,19% overtake Sweden (9,88%). Austria with 7,73% remains in fifth position while Switzerland (7,45%), the Nordic Cluster (6,81%) and Spain (6,49%) follow.

As regards the per capita parquet consumption, Sweden keeps the first seat (0,86 m2) before Estonia (0,77 m2), Austria (0,76 m2) and Switzerland (0,75 m2). In the total FEP area, the consumption per inhabitant slightly increases at 0,21 m2 in 2020 and 2021.

The production in FEP territory rose significantly by almost 6,92% in 2021 and exceeded the 82 million square meter threshold, to be precise with a volume of 82,624,000 m2. A level not seen since the start of the financial crisis, according to the federation. The European production outside FEP countries is at an estimated 15,3 million square meters – 9,7 million square meters produced in EU countries and 5,6 million square meters in European non-EU countries.

Taking into account the total production in Europe (FEP countries + non-FEP countries in Europe) implies that production in 2021 rose by 7,88% and reached almost 98 million m2.

The 2021 total parquet production per type remains similar to the picture already presented from 2010 onwards, FEP explains, whereby multilayer comes in first with 83% (compared to 82% in 2020), being followed by solid (including lamparquet) at 15% (compared to 16% in 2020) and mosaic with a stable 2% of the total cake.

In absolute production figures by country, Poland maintains its top position at 16,06%. Sweden keeps its second place on the podium with 14,94%. It is followed by Austria at 13,00%, while Germany comes in as fourth (9,94%).

The usage of wood species in 2021 indicates that the share of oak remains stable at 81,9% (compared to 81,8% in 2020). Tropical wood species represent 2,1% of used wood. Ash and beech are still the two other most common chosen species with 5,3% and 2,8% respectively.

FEP’s outlook for 2022 and 2023 is as follows. The European parquet markets show diverse evolutions for the first quarter 2022 compared to the same period last year. While Italy, Scandinavia and Spain report still significant increases in demand, Benelux, France and Switzerland present flat evolutions. On the other hand, Austria and Germany are already experiencing decreases, reflecting the difficulty to fill in orders. “This phenomenon is expected to be reported by all markets in the coming months as most of the FEP members are facing issues of wood supplies.”

FEP: “Issues of wood and wood products availability and affordability are limiting the positive evolution of the parquet industry since the outburst of the pandemic, reflecting high demand for wood and supply chains’ disruptions, but they are now getting even more acute with the geopolitical turmoil. A significant part of wood raw material and semi-finished products used by European parquet producers came from Ukraine, Russia and Belarus. These trade flows have been impacted by the situation and the related measures. Due to the already very tense situation on the wood markets and the ecological responsibility, it is not possible for the sector to fully diversify sources of wood to other species and/or other countries.”

FEP, regarding the EU: “The European parquet industry is thus asking the EU authorities for temporary safeguarding, mitigation and support measures to the sector, for a tool, such as a quota, to keep oak logs within Europe and for coherent policies allowing higher mobilization of existing European wood resources (Forestry Strategy, Biodiversity Strategy...) as long as principles of Sustainable Forest Management are applied. A longer-term perspective to explore sustainable (and recyclable) substitutes and alternatives to oak should also be adopted.”

|

Production and consumption developments 2021/2020. |

FEP/GFA, June 2022

top

The European Federation of the Parquet industry (FEP) states that geopolitical turmoil further impacts the already tight wood supply conditions for European parquet markets. Also, the European parquet markets show diverse evolutions for the first quarter 2022 compared to the same period last year.

While Italy, Scandinavia and Spain report still significant increases in demand, Benelux, France and Switzerland present flat evolutions. On the other hand, Austria and Germany are already experiencing decreases, reflecting the difficulty to fill in orders. This phenomenon, says FEP, is expected to be reported by all markets in the coming months as most of its members are facing issues of wood supplies.

FEP: “Issues of wood raw material availability and affordability are not new and are limiting the positive evolution of the sector since the outburst of the pandemic, but they are now getting even more acute with the dramatic evolution of the geopolitical situation.”

A significant part of oak supplies to the European producers of parquet, FEP explains, comes from Ukraine and Russia. Besides wood logs, supply issues for semi-finished wood-based products are also reported. They were already due to a lack of workforce in Ukraine, international payment difficulties with Russia, transport difficulties with both countries, and countermeasures taken by Russia to stop its exports to the EU of some wood products. Additionally, on 8 April, the European Commission has prohibited imports of all wood products from Russia – that was already the case for wood products coming from Belarus.

Finally, FEP remarks that PEFC and FSC consider wood and wood-based materials from Russia and Belarus as ‘conflict wood’ (FSC is also now suspending certificates for wood coming from Ukrainian war zones), wood originating from Russia and Belarus is ‘practically’ not EUTR compliant, and NGOs put pressure to stop any wood/wood products trade flow with Russia and Belarus.

FEP: “In order to limit the impacts of the present crisis on the parquet industry, FEP urges the European Commission to take (temporary) safeguarding, mitigation and support measures, and adopt coherent policies allowing mobilization of EU wood resources and tools to keep oak logs in Europe.”

A brief per country recap by FEP is provided below.

Austria

Despite a strong demand, the Austrian parquet market decreased by 7% during the first quarter 2022 compared to the same period in 2021, reflecting the increasing difficulty to fill in orders. It is right now impossible to forecast the situation in the coming months.

Benelux

Parquet demand is present on the Benelux markets but materials are lacking. Energy costs are staggering and lots of uncertainties are present regarding the near future.

France

French parquet consumption rose by 11% in 2021 compared to 2020, but the first quarter 2022 is showing a flat evolution as it is difficult to answer to the high demand.

Germany

As stocks have been already depleted during the 2nd half of 2021, orders are difficult to fill in and parquet consumption fell by 4% in Germany during the 1st quarter 2022 compared to the same period last year.

Italy

The booming Italian market progressed by 10% during the first quarter 2022 compared to the first quarter 2021. There are lots of orders but the problem is to supply them. At that time, it is possible to deliver with delays but in the coming months fulfilling orders will be a challenge.

Nordic cluster

As in Sweden, but to a lesser extent, Nordic parquet markets are supported by postponed projects and renovation dedicated to new ways of living. They increased by 5-10% during the 1st quarter 2022 but this trend could reach an end after the 2nd quarter of the current year.

Spain

Spanish consumption rose by 3% in 2021 compared to 2020. The same increase is observed during the 1st quarter 2022 compared to the 1st quarter last year. Nevertheless, increases in costs and lack of workforce are hampering forecasts for the coming months. Inflation could also reduce consumption in the 3rd quarter 2022.

Sweden

The delays in and postponements of projects during the pandemic, and renovation, boosted the Swedish parquet market by 10-15% during the first quarter 2022 compared to the same period last year. This evolution won’t probably last beyond the 2nd quarter of this year.

Switzerland

Compared to 2020, parquet consumption in Switzerland increased by 10% in 2021 but the evolution is flat for the 1st quarter 2022 compared to the 1st quarter 2021. Stocks are now very low. And a flat development is also forecast for the 2nd quarter 2022.

FEP/GFA, April 2022

top

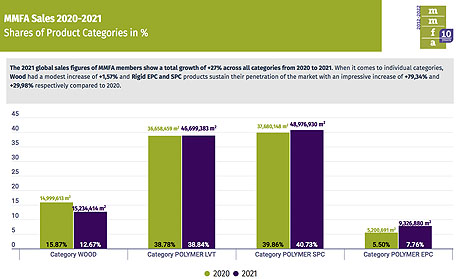

The global sales figures of members of the Multilayer Modular Flooring Association (MMFA) show a total growth of 27% across all categories in 2021 compared to 2020. Members’ sales figures for all polymer products recorded a total growth of 32%, with Rigid EPC and SPC products showing an impressive increase of 79% and 30% respectively. Contrary to previous years, sales of wood products flattened (+1,6%).

Amongst MMFA members, Western Europe and North America consistently rank as leading markets in terms of volume of sales, while Africa, Latin America, Asia and Australia and Oceania are regarded by the association as the most dynamic markets, with sales growth having doubled and even tripled since 2020. “Finally, despite the current situation, our Eastern Europe members’ market share of 6% for SPC products shows significant market growth potential in the region,” says MMFA.

Overall, in 2021 sales of wood flattened for MMFA members compared to last year, with a total of 15 million m² sold worldwide (+1,6%). Meanwhile, members’ sales of polymer products have continued to grow across all regions and reached 105 million m² total sales. LVT sales particularly increased this year (27%), while SPC sales recorded plus 30%. Both categories respectively sold 46 million and 49 million m² throughout 2021. Finally, EPC sales also recorded a significant increase amongst MMFA members, with 80% and 9.3 million m² sold this year.

Members in Western Europe and North America account for 90% of sales for all categories of polymer products, except for wood, with the USA, Germany and France ranking as the top three markets. France is nevertheless significantly bigger than Germany when it comes to LVT clic sales.

Looking at MMFA sales of all polymer accrued products per total volume of sales per region, Western Europe ranks first with 54 million m² sold, followed by North America (41 million m²), Eastern Europe (6.1 million m²), Asia (2 million m²), Australia/Oceania (811.617 m²), Africa (654.124 m²) and Latin America (634.731 m²).

|

The USA is the biggest MMFA market in North America this year for all polymer accrued products by far, selling 39 million m². In Western Europe, the biggest markets for all polymer accrued products in 2021 were Germany (17 million m²), France (14 million m²), Great Britain (5 million m²) and the Netherlands (4.5 million m²).

Germany was also the biggest market for rigid accrued polymer this year, with 10 million m² sold in total, followed by France (6 million m²) and the Netherlands (2.6 million m²). The USA remains the biggest market for rigid accrued MFFA sales in North America as well, with 21.5 million m² sold in 2021. Looking at the Eastern Europe market, Poland ranks first (1.4 million m²), followed by the Russian Federation (369.667 m²). Meanwhile, Australia recorded 655.413 m² of accrued polymer products sold, after the country became a rigid market due to what the MMFA calls ‘historically bad experience caused by extreme exposure to sunlight’.

When it comes to sales of LVT clic, France positions itself as the biggest MMFA market in Western Europe, with 8.2 million m² sold. It is followed by Germany with 6.9 million m², Great Britain (3.3 million m²), the Netherlands (1.9 million m²) and Switzerland, with 295.083 m² sold in 2021. In Eastern Europe, the Russian Federation was the biggest market for LVT clic this year (912.887 m²). In North America, the USA still stands as the biggest market, having sold 17.4 million m² of LVT clic products in 2021.

For wood products, MMFA’s biggest markets in 2021 were Germany (10.1 million m²), Austria (1.5 million m²) and Switzerland (493.693 m²). In Eastern Europe, the Czech Republic was the biggest market, with 432.194 m² sold. Finally, in North America, Canada was the most significant market for wood products, with 82.084 m² sold this year.

Overall, while the association sees that Western Europe (+43,7%) and North America (+16%) members are leaders when it comes to the total volume of sales of all accrued polymer products, MMFA’s African market, although starting with lower bases, is growing at triple rates with an increase of 247% in sales of EPC products (77.931 m²) in 2021 compared to 2010. Their Asian market also shows a nice and even spread across a number of countries for all polymer products, with sales of SPC products being the most significant this year, with a 188% increase compared to 2010 (649.806 m² sold).

Latin America and Australia and Oceania members have also doubled their volumes of sales compared to 2020, both recording an increase of 88% and 102% respectively across all polymer accrued products. Finally, despite the current situation, the Eastern Europe members represent a significant market size, already accounting for 6% of MMFA’s market shares for all polymer accrued products.

Meanwhile, MMFA members in Western Europe account for most market share of wood products sales, with 92%.

|

MMFA/GFA, March 2022

top

For the second year in a row, EPLF members have continued to prosper. In 2021, EPLF members’ sales growth persisted with an increase of 5,3 percent compared to 2020, and a total of 483.4 million square meters of laminate flooring sold.

EPLF remarks that members had already benefited from what it calls the ‘consumer craze for DIY and interior design’ in 2020 by growing their business by 2,7 percent compared to 2019. “Despite the difficulties in sourcing raw materials and the disruptions in the supply chains, our members have shown extraordinary resilience, and a capacity to seize any opportunities to foster business growth.” Looking at the global markets, Latin America witnessed the relatively biggest growth in 2021, with 61,5 percent in comparison to 2020, and 22.8 million m² of flooring sold. Looking back, EPLF underlines that 2021 is the year with the strongest sales since 2010.

Sales in Western Europe reached 231.5 million m² in 2021, an increase of 2,59 percent compared to 2020. In line with previous years, Germany remains the biggest market in this region, with 49.4 million m² sold in 2021, despite a decrease of 6,12 percent compared to 2020. The second strongest market, France, grew by 13,30 percent compared to 2020, with a total of 42 million m² sold in 2021. Great Britain places itself in third position, despite a decrease of 5,72 percent since 2020, with 34.6 million m² sold this year. Turkey, Netherlands, Spain and Belgium are ranked behind Great Britain.

|

In Eastern Europe, Russia, the biggest market, continued to grow with 16,24 percent compared to last year, and a total of 53.6 million m² of flooring sold. Poland comes second with 30 million m² sold (3,64 percent higher compared to 2020). Romania comes in third place this year, ahead of Ukraine, with a growth of 3,14 percent compared to 2020 and 9.8 million m² of flooring sold. Meanwhile, sales in Ukraine decreased by 18,63 percent (8.4 million m² sold). Georgia is the country to have experienced the biggest increase in the region, with 37,74 percent compared to 2020.

In 2021, North America experienced a decrease in sales, with the US witnessing minus 21,46 percent compared to 2020. Canada on the other hand pursued its growth, with 16,80 percent more sales and 12.8 million m² flooring sold.

Contrary to 2020, Latin America, Asia and Australia/Oceania have all seen an increase in sales this year, with each region recording 61,58 percent, 30,45 percent and 12,78 percent growth respectively. Finally, all other countries however reported a decrease in sales of 22,59 percent compared to 2020 (and 1.81 million m² of flooring sold).

|

EPLF/GFA march 2022

top

The European Federation of the Parquet industry (FEP) estimates, based on information from member companies and national associations, that the overall consumption figures on the European parquet market for the year 2021 are significantly increasing by 5,8 percent compared to 2020.

FEP underlines that this is a first prognosis subject to variations, in anticipation of the complete data to be communicated next June during its general assembly in Hamburg. After a stable year in 2020, the European consumption of parquet rose by 5,8 percent in 2021 despite the pandemic. Consumption of parquet has increased on all European markets especially during the first semester of 2021, when compared to the same period in 2020. During the rest of the year, demand continued to grow but at a slower pace, FEP observes, as consumers restarted to dedicate their spendings to areas such as leisure and travels. According to the Brussels based federation, renovation and adaptation of homes to ‘post-covid-19’ life, nevertheless remains the driver of the parquet consumption growth.

As usual, the results show variations from country to country, also reflecting the evolution of the pandemic and the related governmental measures in the different member states in 2021 and 2020. Countries such as France and Italy, which were not able to offset the loss experienced during the spring 2020 lockdown and reported declines in parquet consumption for the year 2020 as a whole, are showing the largest increases in parquet consumption in 2021 compared to 2020.

On the other hand, countries which totally, or partially, compensated, during the second half of 2020, the bad performance observed in March-April of the same year, generally report lower but still sustained increasing rates. This is the case for Austria, Germany, Scandinavia and Spain while the Swiss parquet market shows a significantly higher progression rate.

All member states are now back or even beyond consumption levels of 2019 and demand is continuing to progress. FEP: “However, it is sometimes difficult to fulfill orders on time as the issue of raw material supply - availability and affordability - remains acute. Supply of glues, lacquers... and now staggering energy costs are also hampering the positive evolution on the European parquet markets.”

“It is time,” FEP concludes, “that the European authorities consider the raw material issue and take relevant measures. This is paramount if those authorities want that wood products play effectively their positive role and tackle climate change by saving CO2!”

FEP/GFA, January 2022

top