News 2014

News

News 2021 - archive

News 2020 - archive

News 2019 - archive

News 2018 - archive

News 2017 - archive

News 2016 - archive

News 2015 - archive

News 2014 - archive

News 2013 - archive

News 2012 - archive

News 2021 - archive

News 2020 - archive

News 2019 - archive

News 2018 - archive

News 2017 - archive

News 2016 - archive

News 2015 - archive

News 2014 - archive

News 2013 - archive

News 2012 - archive

News 2014 - archive

Market update FEP

The Board of Directors of the European Federation of the Parquet Industry met on 30 September 2014 and discussed amongst others both the parquet situation and recent economic indicators on the European market. A brief per country recap is provided in the table below.

The Board of Directors of the European Federation of the Parquet Industry met on 30 September 2014 and discussed amongst others both the parquet situation and recent economic indicators on the European market. A brief per country recap is provided in the table below.

Austria

The market declined by an estimated 3% compared to the same period last year.

Belgium

The information provided to FEP points in the direction of a stable market compared to the same period of last year.

Denmark

The market remains stable when compared to the first eight months of 2013.

Finland

Parquet sales are down by an estimated 5 to 7%. The activity on the market is rather low and greatly dependant on Russia. The economy follows a downward trend.

France

The market saw a decline of 10 to 12% in the first nine months of 2014. The trend forecast is negative as well. The confidence at the end-consumers level is quite low and they have adopted a ‘wait and see’ attitude.

Germany

The positive development of the first four to five months of 2014 has unfortunately not continued. June, july and august were predominantly regressing. Compiled data indicate that parquet sales in the first eight months of the current year have declined by 1 to 2%.

Italy

Altogether, the consumption remains low. Parquet sales are down 20%, but ceramics are also losing an estimated 15%. Overall expectations are subdued.

Netherlands

The market is still characterised by an important overcapacity in production (facilities). The contraction of the past years did not affect the production capacity. Therefore, producers look for export possibilities. The parquet consumption continues to fall, but at a slower pace than expected. Despite the fact that the economy is recovering slowly, this development remains to be seen in the parquet sector.

Norway

The Norwegian parquet market showed no major changes compared to last year, the market is stable.

Spain

Generally speaking, the public attitude is one of waiting for the tax reforms. Unemployment remains a major problem. Nevertheless, the market seems stable, but at a low level.

Sweden

The Swedish market has grown by some 3%. House building is picking up, especially the construction of one family houses.

Switzerland

For the first time in ten years, the market is flat. Both mosaic and 3-strip products are further declining. DIY chains now represent an estimated 10% of the total market. LVT is picking up.

GFA/FEP, October 2014

top

Changes in EU wood flooring exports and imports

In 2013, around 25% of all ‘real wood’ flooring manufactured in the 28 countries of the EU was exported to non-EU countries. However, the pace of increase in exports slowed in the first four months of 2014, with a slowdown in economic growth and political problems in several major external markets, according to a recent ITTO TTM Report (Vol. 18 No. 14).

EU exports of wood flooring have been rising in recent years as European manufacturers focused on diversifying overseas markets in the face of weak domestic demand, the report explains. Total EU exports of wood flooring increased 4.7% to 17.78 million m2 between 2012 and 2013. There was growth in exports to Switzerland and Norway, by far the largest export destinations (both countries circa 5 million m2). However there was also significant growth in exports to USA, Turkey, Ukraine, China and Hong Kong in 2013.

Between January and April 2014, the EU exported 5.64 million m2 of wood flooring, just 1.3% more than the same period in 2013. This year, exports have continued to rise strongly to Norway, Turkey, China and Hong Kong. However, the rate of export growth has slowed to the USA, while exports to Switzerland and Ukraine have been declining in 2014. Exports to Russia began to decline in 2013 and this trend has continued in 2014.

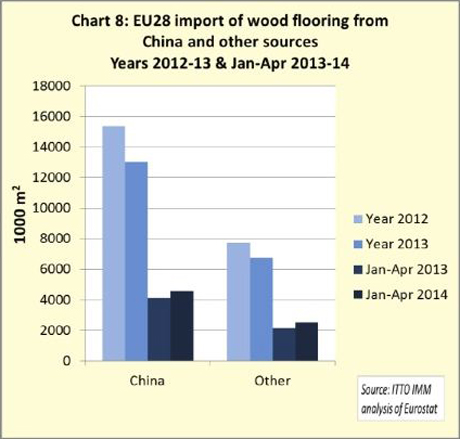

Imports of ‘real wood’ flooring from outside the EU supply around 22% of total consumption throughout the region, the ITTO TTM Report continues. EU imports of wood flooring declined 14% from 23.1 million m2 in 2012 to 19.8 million m2 in 2013. Imports from China, by far the largest external supplier, fell 15% from 15.4 million m2 in 2012 to 13.0 million m2 in 2013. This was due to the combined effects of very slow construction activity and consumer demand in Europe, alternative flooring products, rising costs in overseas manufacturing locations, and diversion of supply to more dynamic emerging markets, according to the report.

However, EU imports of ‘real wood’ flooring have been rising again this year. Between January and April 2014, the EU imported 7.1 million m2 of wood flooring, 13.2% up on the same period in 2013. Imports from China were 4.6 million m2 in the first four months of 2014, 11% more than in the same period the previous year. Imports have also risen from Ukraine, Malaysia, Vietnam and Russia this year. Imports from Indonesia and Thailand have continued to decline.

GFA/ITTO TTM Report, August 2014

top

EU exports of wood flooring have been rising in recent years as European manufacturers focused on diversifying overseas markets in the face of weak domestic demand, the report explains. Total EU exports of wood flooring increased 4.7% to 17.78 million m2 between 2012 and 2013. There was growth in exports to Switzerland and Norway, by far the largest export destinations (both countries circa 5 million m2). However there was also significant growth in exports to USA, Turkey, Ukraine, China and Hong Kong in 2013.

Between January and April 2014, the EU exported 5.64 million m2 of wood flooring, just 1.3% more than the same period in 2013. This year, exports have continued to rise strongly to Norway, Turkey, China and Hong Kong. However, the rate of export growth has slowed to the USA, while exports to Switzerland and Ukraine have been declining in 2014. Exports to Russia began to decline in 2013 and this trend has continued in 2014.

Imports of ‘real wood’ flooring from outside the EU supply around 22% of total consumption throughout the region, the ITTO TTM Report continues. EU imports of wood flooring declined 14% from 23.1 million m2 in 2012 to 19.8 million m2 in 2013. Imports from China, by far the largest external supplier, fell 15% from 15.4 million m2 in 2012 to 13.0 million m2 in 2013. This was due to the combined effects of very slow construction activity and consumer demand in Europe, alternative flooring products, rising costs in overseas manufacturing locations, and diversion of supply to more dynamic emerging markets, according to the report.

However, EU imports of ‘real wood’ flooring have been rising again this year. Between January and April 2014, the EU imported 7.1 million m2 of wood flooring, 13.2% up on the same period in 2013. Imports from China were 4.6 million m2 in the first four months of 2014, 11% more than in the same period the previous year. Imports have also risen from Ukraine, Malaysia, Vietnam and Russia this year. Imports from Indonesia and Thailand have continued to decline.

|

GFA/ITTO TTM Report, August 2014

top

European parquet industries in 2013

The most recent FEP data show that, compared to 2012, the overall consumption figures in 2013 point to a decline of 2.6%. The production in FEP territory went back by 1.81% to 67 million square meters, while the European production outside FEP countries reached an additional 10 million square meters.

The most recent FEP data show that, compared to 2012, the overall consumption figures in 2013 point to a decline of 2.6%. The production in FEP territory went back by 1.81% to 67 million square meters, while the European production outside FEP countries reached an additional 10 million square meters.

Consumption in the FEP area declined by 2.6%, to a level of 82,681,000 m2, compared to 84,888,000 the year before. This somewhat better result than initially forecast at the Domotex in January can, according to FEP, be explained by the good performance of certain markets towards the end of 2013 as well as some requested updates to the 2012 consumption figures. In terms of consumption per country, Germany maintains its first position with 23.91% and is still followed by France which is losing some more ground to 14.03%. Italy was able to maintain its third position with 9.39%, performing slightly better than last year. The per capita parquet consumption is now the highest in Switzerland (0.79 m2), followed by Austria (0.77) and Sweden at 0.65 m2. In the total FEP area, the consumption per inhabitant lost one point at 0.21 m2 in 2013.

FEP: “As far as production is concerned, the trend already witnessed in the previous years, namely the strategic choices made by several producing companies to relocate their production in European countries outside the FEP territory, was once again confirmed and further amplified.” The production in FEP territory went back by 1.81% to 67,027,450 million square meters, while the European production outside FEP countries reached an additional 10 million square meters (2012: 7 million m2). Therefore the total production in Europe (FEP countries + EU outside FEP) is estimated to reach just over 77 million m2. In absolute production figures by country, Poland is consolidating its top position and approaching the 20% threshold (19.81)%, Germany still ranks second with an improved score at 15.48% and Sweden completes the usual podium with 13.1%. The 2013 total parquet production per type remains similar to the picture already presented from 2010 onwards, whereby multilayer comes in first with 78%, being followed by solid (including lamparquet) with 20% and mosaic at 2% of the total cake.

The usage of wood species in 2013 indicates that oak is advancing further and passed the 70% threshold for the first time, to reach 70.9%. Tropical wood species continue their downward trend and now show a mere 5.8%. Ash and beech remain the two other most common chosen species with 5.1% and 4.6% respectively, FEP concludes.

|

The general picture is not uniform, with considerable variations from country to country

|

GFA/FEP, June 2014

top

Market update FEP

The Board of Directors of the European Federation of the Parquet Industry (FEP) met on 28 April 2014 and discussed amongst others both the parquet situation and recent economic indicators on the European market. In the south, the markets remain difficult. In some countries the lights are back on green.

The Board of Directors of the European Federation of the Parquet Industry (FEP) met on 28 April 2014 and discussed amongst others both the parquet situation and recent economic indicators on the European market. In the south, the markets remain difficult. In some countries the lights are back on green.

“Though it is yet too early to give a reliable forecast for the current year, the information provided by the individual country representatives indicates that the European parquet producers continue to face important challenges,” says the federation. “However, the lights are (slightly) back on green in some countries, whereas the situation is back to a level of stabilisation in some others. In the south, the markets remain difficult. The lack of consumer confidence, a weak European construction sector as well as an ever increasing competition are the daily challenges of our industry.”

A brief per country recap, provided by FEP:

Austria

The harsh winter conditions of last year are now behind in Austria and a small increase of around 1% is foreseen in consumption in the first quarter of 2014 compared to Q1/2013. The market is moreover evolving towards more competition from LVT.

Belgium

After a stabilisation in the past few months, the first quarter of 2014 seems to be following the same path. The total construction output fell by 1.3% in 2013, with non-residential construction being the only segment to improve both in the new (+2.2%) and the renovation subsectors (+1%).

Denmark

Parquet sales remain flat in the first three months of 2014 when compared to the same period in 2013. When it comes to the annual evolution, a positive tendency of a few percent is forecast.

Finland

The consumption of parquet remains stable in Q1/2014. The market is relatively small at the moment, with an estimated 1.000.000 square meters being sold a year.

France

The first quarter of 2014 showed a decrease of an estimated 8 to 10% in parquet sales. Consumer confidence is still lacking. Traditional dealers do not necessarily see parquet as a priority. Competition is getting fiercer.

Germany

The volume of consumption remains virtually unchanged. As in the past, the planks tend to become increasingly popular. The DIY stores are moving towards new products, e.g. LVT. Despite the good economic situation in Germany, the parquet market remains stable at around 0% with more competition from other products.

Italy

The parquet market did not start too badly this year, but soon lost some ground. The consumption is estimated to have decreased by 10% in Q1/2014 compared to the same quarter in 2013. Moreover, the yearly consumption for 2013 is expected to follow the same development compared to 2012. There are a lot of new competitors on the market and some confusion at the moment.

Netherlands

The negative trend witnessed at the end of 2012 was put to an end in 2013. The market remains now stable in terms of consumption. The results of Q1/2014 are in line with those of Q1/2013. It is also forecast the 2013 will be very comparable to 2014.

Norway

Just like its Swedish neighbour, the Norwegian parquet market is estimated to have gained a couple percent in Q1/2014 compared to Q1/2013. Also worth mentioning is that the imports of building materials have increased by 18% in the first 3 months of 2014, which shows that there is an active market.

Spain

Parquet sales in the first quarter of 2014 went down by approximately 5% compared to the same period of last year. However, optimism seems to come back slowly. Some macroeconomic indicators are recovering but do not translate into reality at the microeconomic level.

Sweden

Parquet consumption is slightly better in Q1/2014 compared to Q1/2013, with a small rebound of +/- 2%. The housing sector is also starting to recover, which makes the market a little more active than in the previous months.

Switzerland

The mood in Switzerland remains sound. The non-existing winter enabled to record positive parquet sales in the order of +5%.

GFA/FEP, May 2014

top

FEP: further contraction in 2013

After a year in which the overall consumption figures of the European parquet Industry contracted by 5.88%, the first forecasts for 2013 seem to follow a similar trend. FEP’s (European Federation of the Parquet Industry) preliminary forecast indicates a further contraction in the order of 5%.

After a year in which the overall consumption figures of the European parquet Industry contracted by 5.88%, the first forecasts for 2013 seem to follow a similar trend. FEP’s (European Federation of the Parquet Industry) preliminary forecast indicates a further contraction in the order of 5%.

As was witnessed in the past few years, the results show some variation from country to country and even from quarter to quarter, FEP explains. “However, the overall picture does not seem as polarized as it once was. Indeed, countries which were performing rather well and driving the markets upwards also seem to lose momentum.” This first prognosis is subject to variations, in anticipation of the complete data to be communicated at FEP’s annual General Assembly at the beginning of June in Malaga.

FEP continues: “From a regional perspective, it can be stated that markets in the south of the EU (e.g. Spain, Italy, and France) still face serious difficulties, with losses which could reach double digits. In the north, the situation is somewhat better but developments are still slightly negative or, in the best case, stable (e.g. in Sweden). Central Europe remains the best performing region, where Switzerland confirms its status of steady ‘parquet country’ with an expected growth of 6%. Both Austria and Germany should however also see a consumption evolution for 2013 just below zero.” According to FEP, these figures and tendencies have to be seen in the light of “the major challenges which the sector faced in 2013 and still faces today, notably the continuously stiff competition, extremely high unemployment rates in some important EU regions and the never certain exchange rates, especially the EUR/USD ratio.”

FEP expects that the latest - optimistic - economic forecasts of the EC could well give a boost to overall consumer confidence throughout Europe. Furthermore, the Brussels based federation stresses the conclusions of the FEP perception studies, which apparently show that ‘real wood’ flooring is much valued by consumers. In this context, FEP Chairman Lars Gunnar Andersen comments: “We have all the reasons to believe that the current trend is a cyclic evolution but not a structural change. We are witnessing a downsizing of the market, which does not mean that it is altogether absent. Even if the exponential growth witnessed between 1991 and 2007 has seen downward corrections in the recent past, there is no doubt that better days are ahead of us.”

GFA/FEP, January 2014

top

EPLF-members achieve sales of 463 million m2

Even though slight sales declines continued to be observed in Western Europe, 2013 remained a good year for the EPLF (Association of European Producers of Laminate Flooring) thanks to gains in the other regional markets.

Even though slight sales declines continued to be observed in Western Europe, 2013 remained a good year for the EPLF (Association of European Producers of Laminate Flooring) thanks to gains in the other regional markets.

EPLF: “Although the financial crisis does not appear to be completely over yet, the international laminate flooring market is recovering.” Growth has been seen particularly in Eastern Europe, as well as in exports to Asia and North America. The upward trend for EPLF producers that began to emerge in the previous year has stabilised, EPLF says. In 2013, the EPLF’s 21 ordinary member companies (manufacturers of laminate flooring) sold 463m m2 of European-produced laminate around the globe (previous year: 460m m2), representing a global market sales increase of approx. 0.7%.

In 2013, the western European core markets in the European laminate flooring industry experienced a slight decline of just under 3% overall. In absolute figures, western European sales fell from 298m m2 in 2012 to 290m in 2013. Germany saw a decline with approx. 72m m2 (prev. year: 76m), yet remained the largest single market, leading the ranking of western European markets. Turkey occupied second place with over 65m m2 (prev. year: 66m). This slightly lower but, according to EPLF, still satisfactory result was achieved partly thanks to the Turkish member companies of the EPLF, and partly due to economic growth in this country. France saw a slight decline with 39m m2 (prev. year: 40m) and continued to hold third place within Europe. The United Kingdom was stable with 29m m2 (prev. year: 29m) and held fourth place, while the Netherlands occupied fifth place with 19m m2 (prev. year: just under 19m). Spain remained in sixth place with 14m m2 (prev. year: 15m).

European laminate flooring manufacturers sold 103m m2 (prev. year: 99m) in Eastern Europe in 2013, an increase of 4% compared with the previous year. Poland once again came top with approx. 25m m2 (prev. year: 24m). With 23.9m m2 (prev. year: 23.7m), Russia held a strong second place in the sales ranking, and promises further growth rates in the future, expects EPLF. Romania occupied third place with 10m m2 (prev. year: 9.8m), while Ukraine maintained its fourth place with a rise to 9 million (prev. year: 8m). Hungary remained in fifth place with 4.6m m2 (prev. year: 4.2m).

In 2011, sales in North America had dropped from 41m m2 in 2010 to 27m m2, while only 23m m2 was achieved in 2012. This was caused by the challenging economic situation in the USA, EPLF explains. In 2013, North American sales picked up once more, with 28m m2. The USA in particular showed an ‘encouraging’ result for European laminate flooring manufacturers, EPLF reports, with 16m m2 (prev. year: 12m). Canada remained stable in 2013 with 11m m2 (prev. year: 11m).

In Asia-Pacific, the total sales of European manufacturers for 2013 stood at approx. 13m m2 (prev. year: 12m), representing a slight increase. The Chinese market, including Hong Kong, showed particularly clear growth due to exports from European producers in the premium sector – this market achieved sales of over 4m m2 (prev. year: 3m) in 2013. The Iranian market fell even further in 2013, achieving less than half of its already rather ‘poor’ 2012 sales figure of 1.6m m2. South America remained stable in 2013 with 17m m2 (prev. year: 17m). The Chilean market showed a somewhat ‘disappointing’ result for EPLF compared with the previous year, with sales of 6m m2 (prev. year: 6.5m), while sales in Mexico shaped up better, rising to 5m m2 (prev. year: 4.3m).

|

Sales in global market regions (source: EPLF)

|

GFA/EPLF, January 2014

top