News 2021 - archive

News 2020 - archive

News 2019 - archive

News 2018 - archive

News 2017 - archive

News 2016 - archive

News 2015 - archive

News 2014 - archive

News 2013 - archive

News 2012 - archive

In general, the parquet business keeps on experiencing a moderate growth and benefiting from the encouraging developments of the economy, especially of the construction activity, the European Federation of the Parquet Industry (FEP) reports.

In general, the parquet business keeps on experiencing a moderate growth and benefiting from the encouraging developments of the economy, especially of the construction activity, the European Federation of the Parquet Industry (FEP) reports.

When compared to the same period of last year, the provisional results observed for the first half of 2017 point to a continuation of the positive parquet consumption trends observed in 2016 and during the first quarter of 2017. These relatively promising developments, according to FEP, are registered in all the countries where members of the Brussels based federation are present, including Nordic countries. No decrease of consumption is reported. A brief per country recap is provided in the table below.

Austria

The Austrian parquet sales increased by 2% during the first semester 2017 compared to the same period last year. Nevertheless, the competition from other flooring solutions remains harsh.

Belgium

The indications available point towards a growth of 2.5% of the parquet consumption during the first three months of 2017.

Denmark

The Danish parquet market keeps on growing by 1 to 2%, reflecting the performance of the Danish construction activity, especially for projects and ready-made houses.

Finland

Parquet sales remain stable on the Finnish market, confirming that Finland is getting out of the red zone after several years of negative developments.

France

The French market continues to experience positive trends. Parquet sales grew by an estimated 3% during the first semester 2017.

Germany

Data indicate that parquet sales increased by 2% during the first semester of the current year, reflecting the very good performance of the construction sector. On the other hand, there are shortages of craftsmen and the competition with other flooring solutions remains harsh.

Italy

Parquet sales rose by 1.5% during the first half of the year 2017, reflecting the positive economic developments observed in Italy

Netherlands

The information received points to further significant improvements on the Dutch market – parquet sales rose by an estimated 7% during the first semester 2017, reflecting the performance of the housing sector. The affordability of wood raw material and the availability of some species are problematic.

Norway

Compiled data indicate that the Norwegian market remains stable during the first half of 2017. Prices of apartments increased further during this period.

Poland

The information gathered points to a moderate increase by 2 to 3% of the parquet sales on the Polish market.

Spain

The Spanish market remains stable. All indicators are positive and the expectations for the rest of the year 2017 point to a continuation or an improvement of this trend.

Sweden

Compiled data point to a further significant increase by 3 to 4% of the parquet sales in Sweden during the first six months of 2017. This trend is supported by the stable development of construction projects.

Switzerland

Parquet consumption remains flat in Switzerland during the first semester of 2017. No significant increase or decrease of the market is expected during the second half of the year.

FEP/GFA, September 2017

top

Consolidated data provided by the European Federation of the Parquet Industry(FEP) point to a growth of the global European market by 1,7% in 2016. However, as in the past, the results show some variation from country to country.

Consolidated data provided by the European Federation of the Parquet Industry(FEP) point to a growth of the global European market by 1,7% in 2016. However, as in the past, the results show some variation from country to country.

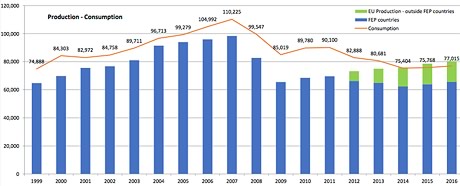

FEP: “After a long period of a challenging market situation for the European parquet producers, the positive indicators of the recent past are now being confirmed and the market is steadily improving.” The overall consumption figures in the FEP area show an increase by 1,7% in 2016, to a level of 77.014.520 m2, compared to 75.768.490 m2 the year before. In terms of consumption per country, this is a status quo compared to 2015. Germany consolidates its first position with 23,65% and is followed by France at 10,63%. Sweden completes the podium with 9,94%. The Nordic Cluster at 8,48% takes the fourth seat. Italy with 8,18% takes back its fifth position from Switzerland (8,05%) and is ex aequo with Austria (8,18%).

As regards the per capita parquet consumption, Sweden has taken the first seat (0,77 m2) at the expense of Switzerland (0,74 m2), which is followed by Austria (0.73 m2). In the total FEP area, the consumption per inhabitant remains stable at 0,19 m2 in 2016.

The production in FEP territory consolidates its growth by 2,5% and exceeds significantly the 65 million square meter threshold. The European production outside FEP countries is at an estimated 14,8 million square meters. FEP: “As far as production is concerned, the strategic choices made by several producers to relocate their production in European countries outside the FEP territory was once again observed.” The total production in FEP territory rose by 2,53% to a volume of 65.603.120 m2. Taking into account the total production in Europe (FEP countries + EU outside FEP), this implies that production in 2016 rose by 2,32% and exceeded 80,4 million m2.

The 2016 total parquet production per type, FEP explains, remains similar to the picture already presented from 2010 onwards, whereby multilayer comes in first with 80% (compared to 79% in 2015), being followed by solid (including lamparquet) with 18% (compared to 19%) and mosaic at 2% of the total cake.

In absolute production figures by country, Poland maintains its top position at 20,08%. Sweden consolidates its second place on the podium with almost 17%. It is followed by Austria at 14,02%, while Germany comes in as fourth.

|

The usage of wood species in 2016 indicates that oak is advancing further and reaches 80,8%, compared to 77,7% in 2015. Tropical wood species use decreased slightly to 4,1%. Ash and beech remain the two other most commonly chosen species with 5,7% and 2,5% (compared to 3,8% in 2015) respectively.

Despite the brightening market picture, the growing shortage of oak as primary raw material source remains a major concern for FEP in the near future. Furthermore, the federation points to the general uncertainties about political changes worldwide, which could have an impact on the European parquet sector. However, despite what FEP calls “the harsh competition from flooring alternatives especially those with a wood look surface”, the Brussels based federation trusts “that end consumers will be increasingly convinced by the inherent advantages of European Real Wood parquet products.”

|

FEP/GFA, July 2017

top

In general, the parquet business seems to experience a moderate growth during the first quarter of 2017. After several years of a subdued market situation, the trends turned positive in the recent past, the European Federation of the Parquet Industry (FEP) reports.

In general, the parquet business seems to experience a moderate growth during the first quarter of 2017. After several years of a subdued market situation, the trends turned positive in the recent past, the European Federation of the Parquet Industry (FEP) reports.

When compared to the same period of last year, the Brussels based federation explains, the first results point to a confirmation and a consolidation of these trends in most of the countries where FEP members are present. It is worth noting the positive developments in all Nordic countries, says FEP. A brief per country recap is provided below.

Austria

The Austrian market is stable despite the competition from other flooring solutions. According to Euroconstruct, the demographic development, the increasing house prices and the low interest rates are pushing private investment in residential housing. The information provided to FEP points in the direction of stable parquet sales.

Belgium

The few indications available point towards a growth of 4% of the parquet consumption during the first three months of 2017, reflecting an estimated increase of 3% in the construction output for the year 2016. Construction in the 1st quarter of 2017 shows a positive trend.

Denmark

The Danish construction activity has grown in 2016, especially in the residential sector. Consequently, the Danish parquet market is slightly growing by 1%.

Finland

Following several years of negative developments, the Finnish market is slowly getting out of the red zone and parquet sales remain stable. The construction output in Finland is increasing significantly for both residential and non-residential buildings.

France

The French market continues to experience positive developments, and parquet sales grew by an estimated 3% during the 1st quarter 2017, though there is no clear view for the future.

Germany

Data indicate that parquet sales in the first quarter of the current year remained stable, confirming the already good performance observed for the first quarter of 2016. The economic situation is positive as well as the construction activity, though it is difficult to find installers for projects.

Italy

Natural disasters and politics have led to a flat market for parquet. According to Euroconstruct, residential renovation and new non-residential buildings are increasing and only new residential construction is still declining.

Netherlands

The information received points to significant improvements on the Dutch market – parquet sales rose by an estimated 4% during the 1st quarter 2017. The construction sector in the Netherlands continues to improve with new residential expanding strongly.

Norway

The Norwegian market was stable in January and February while it increased in March, reflecting heavy investments in building which should benefit parquet in the future. For the whole 1st quarter 2017, sales grew by 1%.

Spain

Spanish parquet sales are stable. The residential housing sector is improving but is still far from its comfort zone. Nevertheless, for the first time since the crisis, there have been more housing starts than completions in 2016.

Sweden

Compiled data point to a significant increase by 3% of the parquet sales in Sweden during the first three months of 2017. Sweden is experiencing substantial growth of construction activity thanks to the good performance of new buildings, and particularly new housing.

Switzerland

Information received points to stable parquet consumption in Switzerland during the first quarter of 2017. According to Euroconstruct, the residential sector is slowing down, registering zero growth in both new and renovation sub-segments after several years of expansion linked to high immigration flows and a catch-up of housing capacity.

FEP/GFA, May 2017

top

According to the first estimates of FEP, the European Federation of the Parquet Industry, the consumption figures of the European parquet industry, after increasing by 0.5% in 2015, progress further by 2% in 2016.

According to the first estimates of FEP, the European Federation of the Parquet Industry, the consumption figures of the European parquet industry, after increasing by 0.5% in 2015, progress further by 2% in 2016.

This forecast reflects an improvement in parquet sales across Europe. It should however be seen as a first prognosis subject to variations, in anticipation of the complete data to be communicated at FEP’s annual General Assembly next June in Budapest, Hungary.

As usual, the results present some variation from country to country whereby almost all countries, with the exception of Finland, show positive developments. From a regional perspective, Sweden, Czech Republic, The Netherlands and Belgium are experiencing the highest growths, followed by France and Poland. As regards the southern European markets, Spain, which is still recovering from low levels of consumption, can count on a favourable economic context while Italy according to FEP is facing risks of a potential political and economic crisis. Austria and Germany, the largest European market, are both growing as well. The Hungarian consumption is also improving but to a lesser extent, while the Swiss parquet market remains stable.

Besides these positive trends, the captains of the parquet industry underline the growing shortage of oak, the general uncertainties about the political developments worldwide and the harsh competition from flooring alternatives - especially those with a wood look surface.

FEP/GFA, February 2017

top

In 2016, producers belonging to the EPLF (European Producers of Laminate Flooring), reported worldwide sales of 476 million m2 of laminate flooring manufactured in Europe (2015: 452 million m2). This equates to an increase of 5.6% when compared to the same period in the previous year.

In 2016, producers belonging to the EPLF (European Producers of Laminate Flooring), reported worldwide sales of 476 million m2 of laminate flooring manufactured in Europe (2015: 452 million m2). This equates to an increase of 5.6% when compared to the same period in the previous year.

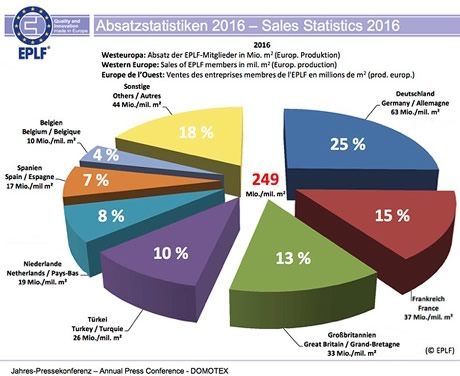

Sales in Western Europe (including Turkey) in 2016 reached the figure of 249 million m2 (2015: 254 million m²), which represents a slight decrease of 1.5% compared to the previous year. With 63 million m² sold (2015: 66 million m²), a decrease of 3.6%, Germany remains by far the most important single market in Central Europe. France remained stable in 2016 with 37 million m² (previous year: 37 million m²). The United Kingdom continued its positive upward trend for EPLF members: in 2016, it registered sales of 33 million m² (p.y. 31 million m²), an increase of nearly 8%. This puts it in third place ahead of Turkey, where turnover for Association members slumped again in 2016: laminate sales fell there by approx. 15% down to 26 million m² (p.y. 31 million m²). The Netherlands can lay claim to fifth place with over 19.3 million m² (p.y. 19.1 million m²). Spain follows on behind with nearly 17 million m² (p.y. 15 million m²), an increase of 8.7%.

Once again, considerably more EPLF laminate was sold in Eastern Europe in 2016 than in the previous year – at 126 million m² (p.y. 111 million m²), European laminate floor producers in that area achieved an increase of 13.4%. In 2016, Russian members of the EPLF reported sales of nearly 34 million m² (p.y. 29 million m²), which means they achieve a growth rate of 16.7%. Poland registered nearly 31 million m² in 2016 (p.y. 28 million m²), a rise of 8.6%. An equally positive trend was seen in Romania with 13.6 million m² (p.y. 11.1 million m²). Subsequent places in the ranking are occupied by Ukraine with 6.2 million m² (p.y. 4.7 million m²) together with Hungary and Bulgaria at 5 million m² each.

In North America, the EPLF’s series of successes in European laminate flooring continues for the fourth year in a row: with 47 million m² in 2016 (p.y. 39 million m²), this region once again managed to increase its growth rate, with 22.6% more sales than in the previous year. The USA demonstrated an increase of 18% in 2016 with 29 million m² (p.y. 25 million m²) and, during the same period, Canada achieved an increase of 30% with 18 million m² (p.y. 14 million m²).

The situation looks similarly positive in Asia-Pacific, where EPLF producers reached total sales of around 27 million m² for 2016 (p.y. 17 million m²), thereby gaining an increase over the previous year of around 54%. Latin America remained broadly stable in 2016 with 17 million m² (p.y. 17 million m²). The sales figures in the largest single market of Chile rose by 7.5% in comparison with the previous year at 7.3 million m² (p.y. 6.8 million m²). Mexico recorded 4.3 million m² (p.y. 4.5 million m²).

|

EPLF Sales Statistics 2016 - Western Europe

|

EPLF/GFA, February 2017

top

The criteria were published in the Official Journal of the EU on February 2nd 2017. This step is intended to provide companies and consumers with a ‘credible’ ecolabel to promote sustainable consumption and production, enhancing circular economy within Europe.

The European Commission has designed a new product group ‘Wood-, Cork- and Bamboo-based Floor Coverings’ replacing the previous criteria for ‘Wooden Floor Coverings’, enlarging the scope of floor covering products. The new criteria require that any virgin wood, cork, bamboo and rattan in the finished products originate from certified sustainably managed forests. In addition, the Commission has introduced a new set of measures to ensure low energy consumption for manufacturing. Furthermore, the new criteria drastically limit the VOCs (Volatile Organic Compounds) content. A significant achievement for consumer safety is banning the use of flame retardants as well as other harmful chemicals.

The criteria for ‘Wood-, Cork- and Bamboo-based Floor Coverings’ will be valid for a period of six years. Webinars and workshops in member states are planned to inform European producers how to obtain the label for their products. More information: ecolabel.eu

|

EC/GFA, February 2017

top