News 2021 - archive

News 2020 - archive

News 2019 - archive

News 2018 - archive

News 2017 - archive

News 2016 - archive

News 2015 - archive

News 2014 - archive

News 2013 - archive

News 2012 - archive

The Board of Directors of the European Federation of the Parquet Industry (FEP) met ‘virtually’ on the 8th of October and discussed, amongst others, the parquet situation and the continuous impacts of the Covid-19 crisis on the European markets.

The Board of Directors of the European Federation of the Parquet Industry (FEP) met ‘virtually’ on the 8th of October and discussed, amongst others, the parquet situation and the continuous impacts of the Covid-19 crisis on the European markets.

FEP observes: “The south of Europe which had experienced the toughest restriction measures during spring had been harshly hit but its parquet markets have also significantly recovered during the summer, before slowing down a bit in September. The main driver of the recovery is renovation, especially residential renovation as the consumers are investing in their homes. On the other hand, new projects and contract business are challenging.”

“Germany, the main European parquet market, which has not been hurt that much during spring, is currently experiencing very positive trends also boosted by renovation.”

FEP continues by stating: “Unfortunately, the current upsurge of the pandemic and the new measures which are taken throughout Europe are creating some uncertainties for the future. Additionally, the economic long-term impacts of the crisis are still to come. Nevertheless, for the year 2020 as a whole, a stable consumption of parquet is forecast on the European markets compared to 2019.”

A brief per country recap is provided by FEP below.

Austria

The situation has started to improve in May. Renovation continues to be the parquet consumption driver and supports the recovery. However, for the whole year, a slight decline of the market compared to 2019 is forecast.

France

After a restart of the consumption mid-May, the situation in France is now ‘neither bad, nor good’. The contract business is significantly decreasing, but the impacts of this decrease will only be visible in two years as for the time being existing contracts are completed. DIY is performing well.

Germany

While the parquet market was subdued in April and May, the trends upturned during the summer and are now very positive in Germany and until the end of the year. New projects are decreasing but renovation is on an increasing path.

Italy

Until August, the Italian market has recovered from the lock-down period, especially in the south of the country which has been less affected last spring. Parquet consumption then slowed down in September but renovation is driving the market while contract business is lower. All the losses from spring will not be compensated but a stable result or a slight decrease only is expected for the year 2020 as a whole.

Nordic Cluster

Nordic cluster parquet market has also been hit during spring. New buildings are down but renovation is strong, especially in Norway. In total, the market is improving.

Spain

While the Spanish market was recovering from the spring lock-down during the summer, the new Covid-19 related measures taken now could hamper this recovery. Renovation is doing well while construction of new buildings is stopped. The long-term economic impacts of the pandemic and the related public expenses are still to come. All in all, a slightly decreasing or a flat parquet market is expected for the year 2020 as a whole.

Sweden

Sweden has been an ‘island’ these last months. The parquet market is a bit down, with less investments, but this is due to structural changes and not a consequence of the pandemic. On the one hand, commercial and hospitality businesses are really challenging. On the other hand, renovation represents a strong market as people are investing in their homes (offices). No significant evolution of the situation is expected by the end of the year but the fourth quarter should be positive.

Switzerland

After a flat third quarter, especially in French and Italian speaking parts of the country, slightly positive trends are now observed on the Swiss parquet market. Renovation is the main driver but alternatives to wood solutions benefit the most. A stagnation is expected for the fourth quarter and the whole year 2020.

United Kingdom

The country has been harshly hit by the pandemic and its market situation is comparable to the south of Europe with a recovery during the third quarter. Nevertheless, the uncertainties related to the Brexit are impacting activities.

FEP/GFA, October 2020

top

After a year of slight contraction in 2018, the overall consumption figures of parquet in Europe upturned for 2019. The consolidated data provided by the European Federation of the Parquet industry (FEP) show an increase by 1.2% of the global European market in 2019 compared to 2018.

After a year of slight contraction in 2018, the overall consumption figures of parquet in Europe upturned for 2019. The consolidated data provided by the European Federation of the Parquet industry (FEP) show an increase by 1.2% of the global European market in 2019 compared to 2018.

Furthermore, the revised figures for 2018 now point to a market contraction of less than 1% compared to 2017. Last year, consumption in the FEP area increased to a level of almost 81.8 million square meters. As usual, the results for 2019 show some variation from country to country. The market improvement is mainly due to increases of parquet consumption observed in Germany, Poland, France, and Italy. On the other hand, Scandinavia is reporting declines.

Consumption in the FEP area rose by 1.2% to reach 81,766,700 m2, compared to 80,827,900 m2 the year before. In terms of consumption per country, Germany reinforces its first position with 21.08%. France at 10.60% and Italy at 10.57% complete the podium. Sweden at 10.07% gets the fourth seat. Austria with 8.04% keeps its fifth position while the Nordic Cluster (7.21%), Switzerland (7.02%) and Spain (7.02%) follow.

As regards the per capita parquet consumption, Sweden keeps the first seat (0.80 m2) before Austria (0.74 m2), Estonia (0.73 m2) and Switzerland (0.67 m2). In the total FEP area, the consumption per inhabitant remains stable at 0.19 m2 in 2019.

The production in FEP territory rose by 1.6% and just exceeds the 78 million square meter threshold. The European production outside FEP countries is at an estimated 14.2 million square meters – 8.7 million square meters produced in EU countries and 5.5 million square meters in European non-EU countries. Adding the two figures implies that production in 2019 rose slightly by 0.7% and reached 92.2 million m2 (2018: 91.6 million m2).

The 2019 total parquet production per type remains similar to the picture already presented by FEP from 2010 onwards, whereby multilayer comes in first with 83% (compared to 82% in 2018), being followed by solid (including lamparquet) with 16% (compared to 17% in 2018) and mosaic at a stable 1% of the total cake.

In absolute production figures by country, Poland maintains its top position at 16.86%. Sweden keeps its second place on the podium with 14.50%. It is followed by Austria at 12.45%, while Germany comes in as fourth (11.25%).

The usage of wood species in 2019 indicates that the share of oak remains stable and reaches 80.6% compared to 80.3% in 2018. Tropical wood species represent 3.4% of used wood. Ash and beech remain the two other most common chosen species with 7.2% and 2.0% (compared to 6.8% and 2.1% in 2018) respectively.

Regarding the upsurge of the Covid-19 in the present year 2020, FEP observes the following: “In a nutshell, the situation is getting worse when going from north to south of Europe, which was hit earlier and harder by the pandemic. Italy, Spain, but also France or Belgium have been locked down for weeks. Non-German speaking parts of Switzerland and Austria were also confronted to this kind of situation. On the other hand, the activity never really stopped in Germany and some shops, such as DIY, were open. And no drastic confinement measures were taken in Scandinavia where life remains as normal as possible.”

FEP continues: “Although the situation is now (end of June, ed.) slowly improving, relatively more quickly in countries less impacted by the lockdown measures, a return to pre-Covid-19 sales level is not expected in the short to medium term. Uncertainties also remain concerning a potential 2nd wave now or next fall.”

With other forest-based and woodworking industries European associations, FEP is calling for a ‘strong’ EU recovery plan in line with the EU Green Deal’s and new Circular Economy Action Plan’s principles which, according to the federation, are generally favourable to wood products such as parquet. “A return to business as usual, meaning a dependence on fossil-based and/or energy intensive resources and products, is simply not an option. More specifically, regarding the construction activity, the so-called renovation wave should be one of the most important engines of the recovery. The present crisis is an opportunity for the EU to make its increasing recognition of the positive role played by wood products tangible and to translate it into supportive policies for our industry!”

|

Production and consumption developments 2019/2018. |

FEP/GFA, June 2020

top

The Board of Directors of the European Federation of the Parquet Industry (FEP) discussed the first impacts of the Covid-19 crisis and concluded, at the beginning of this month, that the South European markets are already severely hit.

The Board of Directors of the European Federation of the Parquet Industry (FEP) discussed the first impacts of the Covid-19 crisis and concluded, at the beginning of this month, that the South European markets are already severely hit.

FEP: “The European parquet markets had generally well started the year showing stable to slightly positive trends in January and February. But March and the arrival of the Covid-19 virus on the European territory put an end to this positive move.” When compared to the same period last year, the provisional results for the three first months of 2020 indicate stable parquet consumption in Scandinavia (except in Sweden for structural reasons), the Baltic States and Germany where the activity is continuing for the time being.

On the other hand, the South of Europe which is experiencing tougher restriction measures is generally already reporting significant declines in parquet consumption. “Although it is right now impossible to predict when activities will restart and how consumption will then evolve, it is obvious that this crisis will have long-term and significant impacts on the European economy and industry,” FEP explains.

A brief per country recap (as per april) is provided below.

Austria

The Austrian parquet sales significantly decreased by 10% during the first quarter 2020 compared to the first three months of 2019. Activity was good in January and February, but the market collapsed in March. Some companies have stopped activities, shops are closed or work on-line only.

Baltic States

Baltic countries’ parquet markets remained flat during the first quarter of the current year. Activities are so far continuing in these countries.

Denmark

The Danish parquet market was flat during the first quarter 2020. Project market is still doing well while the retail shops have started to close with the crisis. People are nevertheless working a lot at home for refurbishing.

Finland

While the Finnish market does not seem to be hit by the crisis so far, starts of new (premium) buildings are declining. All in all, parquet sales were stable on the Finnish market during the first quarter 2020.

France

Compared to the first three months of 2019, parquet consumption fell by 15 to 17% during the first quarter 2020. January and February were normal months of activity, but the French parquet market collapsed in March. All shops are closed. All factories have stopped their activities.

Germany

Parquet sales were flat (0 to -1%) in Germany during the first quarter 2020. The German market was stable until beginning of March which started well compared to 2019. Retail shops are now closed but DIY shops are open in most of the Lands. Companies and installers are still working. Production and construction activities are continuing (with restrictions) for the time being.

Italy

The Italian parquet market declined by 10% during the three first months of the current year. Activity in January was slow then Italy was the first European country hit by the crisis. All factories and shops are closed at least until mid-April and the comeback to normality will take time.

Norway

Data indicates that the Norwegian market remained flat during the three first months of 2020. Restrictive measures are not as strong as in the South of Europe, but Norwegian are staying at home and demand for DIY products for refurbishment, such as paintings, is increasing. This does not concern parquet. Impacts of the unexpected weak Norwegian krone on the 2nd quarter’s activity are difficult to predict at this stage.

Spain

The Spanish market was stable during the first quarter of the year 2020. The quarter started well but March and the crisis put an end to this positive move. Strong lock-down measures are also in place in Spain.

Sweden

Parquet consumption decreased slightly by 3 to 4% during the first quarter 2020 compared to the first quarter 2019. This slight decline is due to structural changes, such as the decrease of starting of new buildings, but does not reflect the current crisis as life is almost normal in Sweden: businesses and shops are open.

Switzerland

Data indicates that parquet consumption fell by 8% in Switzerland during the three first months of 2020. The Swiss market was stagnating before plunging the two last weeks of March. Construction sites are closed and activities reduced. The restriction measures are significantly tougher in the French speaking part of the country.

Due to the situation, the FEP Board of Directors has been forced to cancel the FEP General Assembly & Parquet Congress 2020 which was supposed to take place on 11-12 June in Hamburg.

FEP/GFA, April 2020

top

The European Federation of the Parquet Industry (FEP) estimates, based on information obtained from its member companies and national associations, that the overall consumption figures on the European parquet market for the year 2019 will be flat.

The European Federation of the Parquet Industry (FEP) estimates, based on information obtained from its member companies and national associations, that the overall consumption figures on the European parquet market for the year 2019 will be flat.

FEP underlines that this is a first prognosis subject to variations, in anticipation of the complete data to be communicated at FEP’s annual General Assembly on 11 and 12 June in Hamburg, Germany. After a year 2018 characterized by a moderate drop, the consumption figures of parquet in Europe slightly recovered in 2019. A flat evolution is forecasted for the whole year.

As usual, the results show variations from country to country. The stabilisation of the market is mainly reflecting the moderate upturn of parquet consumption in Germany, the biggest European parquet market. Additionally, the consumption improved in Austria, France, Poland and Spain. However, these positive developments are to be balanced with the decreases observed on the Italian, Swedish, and Swiss markets, as well as in part of the Nordic Cluster (Denmark, Finland and Norway).

Regarding competition, and besides the increasing presence of products with a wood-look, especially LVT, the ‘captains of industry’ in the federation stress the uncertainties created by the so-called ‘trade war’ between the US and China on the global and European markets.

In contrast, FEP sees the European Green Deal - published on 11 December 2019 by the new European Commission and adopted by the European Parliament on 15 January 2020 – as an opportunity for the parquet industry, as it welcomes the strong focus on construction and renovation. “The European parquet industry is offering a circular sustainable product which saves carbon and substitutes energy-intensive and/or fossil-intensive alternatives,” FEP claims, thus supporting the EU in meeting its objectives.

FEP/GFA, January 2020

top

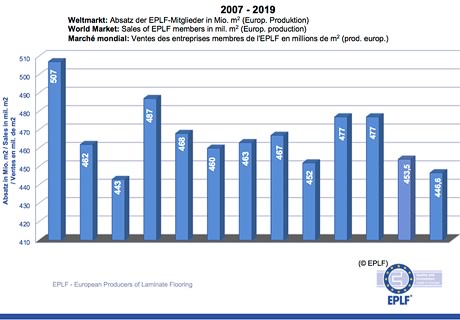

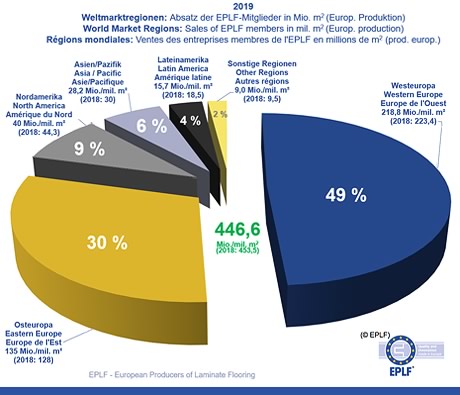

In 2019, worldwide sales of the EPLF members reached 447 million m2 of laminate flooring from European production (2018: 454 million m2, i.e. minus 1.5 percent).

In 2019, worldwide sales of the EPLF members reached 447 million m2 of laminate flooring from European production (2018: 454 million m2, i.e. minus 1.5 percent).

“The second half of 2019 has witnessed an upturn recovering and is stabilizing at a high level, even though the influence of declining world trade remains noticeable globally,” explains the Brussels based association. “The EPLF ‘home market’ of Western Europe fell slightly in 2019, although important Western European countries are currently already reporting positive figures. Eastern Europe also delivered strong figures, while overseas sales experienced a setback.”

|

In Western Europe (including Turkey), total sales in 2019 reached 219 million m2 (225 million m2 in 2018). This represents a decline of 2.1 percent compared to the previous year. Germany remains by far the most important single market in Central Europe with 50 million m2 (52 million m2 in 2018). However, according to the EPLF, the setback is slowing down compared to previous years with a reduction of 5.0 percent.

France remains second in Europe, improving by 1.1 percent in 2019 to 36.5 million m2 (36.0 million m2 in 2018). A positive trend for EPLF members can be seen in Great Britain: at 32.6 million m2 in 2019 (29.8 million m2 in 2018), the dent in the previous year's figure was offset by an increase of 9.5 percent. The country thus continues to rank third in Western European sales ahead of the Netherlands, where association sales in 2019 improved by 1.4 percent to 18.6 million m2 (18.3 million in 2018). Spain also reported positive developments: sales figures for laminate flooring increased by 1.4 percent to 16.7 million m2 (16.5 million m2 in 2018).

A clear upward trend is evident in Eastern Europe. The region, according to the association, confirms its role as an important future market for EPLF manufacturers. With 135 million m2 (128 million m2 in 2018), the European laminate flooring manufacturers achieved a good result there in 2019. EPLF members in Russia reported 43.8 million m2 (39 million m2 in 2018), which corresponds to a growth rate of 11.4 percent. Poland improved by 6.1 percent to 31.2 million m2 (29.5 million m2 in 2018). The Ukraine is developing into what the EPLF refers to as ‘the rising star’ in Eastern Europe: with 10.1 million m2, the country moved into third place in the region (+32.5 percent compared to the previous year with 7.6 million m2). Romania and Hungary are behind with 10 million m2 (11 million m2 in 2018) and 7 million m2 (-2.4 percent in comparison to 2018).

EPLF continues: “After a boom in the USA, North America has returned to a normal level, slowed down by a double-digit reduction in Canada.” In 2019, a total of 40 million m2 (44.3 million m2 in 2018) were sold in North America, around 9.6 percent less than in the previous year. The USA showed a slight setback of 3.2 percent in 2019 with around 29.7 million m2 (30.7 million m2 in 2018), in Canada only close to 10.3 million m2 (previous year 13.6 million m2) were registered in 2019, which means a decline of 24.7 percent.

The smaller export regions showed signs of the slowdown in world trade, the EPLF observes. Asia fell by 6 percent from 30 million m2 to 28.2 million m2 - with the positive exception of the Central Asian republics: Kazakhstan stabilized at the comparatively high level of 4 million m2 with a small increase of 0.1 percent. Latin America declined from 18.5 million m2 in 2018 to 15.7 million m2 in 2019 (-15.2 percent). Africa was also unable to continue the positive trend of previous years. The total sales volume of the various export markets from the north to the south of the continent fell slightly from 5.0 million m2 in 2018 to 4.9 million m2, which corresponds to a decline of 2.1 percent.

|

EPLF/GFA, January 2020

top

The Multilayer Modular Flooring Association (MMFA), which has recently moved to Brussels, reports an increased sales volume for its members, also in 2019. A clear leader appears to be the 'Rigid SPC' subcategory.

The Multilayer Modular Flooring Association (MMFA), which has recently moved to Brussels, reports an increased sales volume for its members, also in 2019. A clear leader appears to be the 'Rigid SPC' subcategory.

In its classification of multi-layer modular floor coverings, which was amended last year, the association distinguishes between three product categories, depending on the floor structure. ‘Polymer’ includes products with polymer core and polymer surface. This has two subdivisions: the traditional LVT click products and the 'rigid' products (or all other polymeric click products based on 'expanded polymer core' EPC or 'solid polymer core' SPC).

'Wood' stands for all products with a composite core, which is mostly based on wood material and provided with a polymer or cork top layer. In the 'Mixed' category the floors of every other structure are classified.

In the 'Polymer' sub-category 'Rigid SPC', the members of the MMFA reach sales of circa 27.6 million square meters (+136 percent), with a volume of 12.0 million m2 for Western Europe (+123 percent) and for North America of 13.9 million m2 (+160 percent). In the year 2018 (when this subcategory was still referred to as 'Class 2-B SPC'), the total volume amounted to 11.7 million m2, with a volume of approximately 5.35 million m2 for both Western Europe and North America.

In the 'Polymer' sub-category 'Rigid EPC', on the other hand, the sum for 2019 amounts to a rounded 6.2 million m2 (-15 percent), with a volume of more than 2.8 million m2 for Western Europe (-7.7 percent) and for North America of nearly 2.8 million m2 (-20.8 percent). In the year 2018 (at the time referred to as 'Class 2-B EPC') the total volume amounted to circa 7.3 million m2, including 3.0 million m2 for Western Europe and 3.5 million m2 for North America.

The large 'Polymer' sub-category of 'LVT click' achieved sales of rounded 45.0 million m2 (+5 percent) last year, with a volume of 26.2 million m2 (+15 percent) for Western Europe and for North America of 13.8 million m2 (-19 percent). In the year 2018 (when this subcategory was referred to as 'Class 2-A’), the total volume amounted to circa 42.8 million m2, with Western Europe reaching 22.9 million m2 and North America still 17.1 million m2.

Finally, the 'Wood' category reached a total volume of little over 12.8 million m2 in 2019, of which 10.1 million m2 was shipped to Germany, Austria and Switzerland. In comparison with the total of 12.1 million m2 from 2018 (then called 'Class 1'), this means an increase of 6.1 percent, and 5.2 percent growth for Germany, Austria and Switzerland (2018: 9.6 million m2).

The total volume of MMF floors thus amounts to 91.6 million square meters in the past year. ‘Polymer LVT’ has a share of 49 percent, ‘Polymer SPC’ advances to 30 percent, ‘Polymer EPC’ has 7 percent and ‘Wood’ the remaining 14 percent.

Looking at the trends, the MMFA observes, among other things, that certain floors are currently being produced without PVC or plasticizers and are as such certified by environmental labels, that ceramine floors, which have an energy-saving production, are establishing themselves as an alternative to traditional ceramic floors and that the manufacturers, on balance, may also this year take into account a continuing and substantial growth of the market.

|

Quick-Step Rigid Pulse Click Vinyl ‘Cotton Oak cozy grey’. |

MMFA/GFA, January 2020

top