News 2021 - archive

News 2020 - archive

News 2019 - archive

News 2018 - archive

News 2017 - archive

News 2016 - archive

News 2015 - archive

News 2014 - archive

News 2013 - archive

News 2012 - archive

European parquet consumption continues to progress thanks to renovation, as reported by the European Federation of the Parquet industry (FEP), but manufacturers still experience tight raw materials supply conditions.

FEP: “Consumption of parquet has increased on all European markets during the first semester 2021 when compared to the same period in 2020 and whatever the strictness of the covid-19 related measures taken at that time in the different countries.”

Renovation, and adaptation of homes to ‘post-covid-19’ life, is still the driver of the parquet consumption growth, according to the Brussels based federation. “The market is expected to progress further until the end of the year but at a slower pace as consumers are restarting to spend in activities and areas which were limited during the sanitary crisis.”

FEP warns nevertheless: “However, availability and affordability of raw materials remain critical and the situation is not forecast to stabilize before spring 2022. Logistics and freights are also an issue while shortages of (skilled) labour forces for manufacturing and installing parquet are increasingly reported by operators.”

A brief per country recap is provided below.

Austria

Consumption of parquet rose by 10% on the Austrian market during the 1st half of 2021. The market is now slowing a bit but is still and should be positive for the rest of the year. Raw material (oak, spruce) availability is an important issue.

Croatia

The Croatian parquet market is improving compared to a critical year 2020. Investments are restarting and demand for new buildings is increasing.

France

Compared to the first semester 2020, characterized by two months of lockdown, French consumption shows a double-digit growth for the first semester 2021. If compared to the same period in 2019, it shows an increase of 5%. DIY is still one of the drivers of the demand while sourcing of raw materials is and will probably remain an issue until spring 2022.

Germany

German consumption of parquet rose by 8-10% during the first half of 2021 compared to last year. The market is now flattening when compared to the 3rd quarter 2020 which showed already positive developments. Availability of raw materials remains an issue.

Italy

The Italian market for parquet grew by 6-7% during the 1st semester 2021 supported by renovation, new buildings remaining subdued. Wood availability is critical.

Nordic cluster

Scandinavia in general is showing the same trends as Sweden, with a still good demand, supposed to remain high in the coming months, but there are problems of supplies.

Spain

The Spanish market for parquet is stable with low import-export flows and shortages of raw materials and labour.

Sweden

Parquet consumption in Sweden showed a double-digit growth during the first six months of the year thanks to a refurbishment rate reflecting the adaptation to ‘post-covid-19’ way of living. However, traffic in retail shops is diminishing and expenses are starting to be dedicated to other activities which were not possible during the sanitary crisis. New buildings are also delayed due to a lack of concrete.

Switzerland

The Swiss parquet market increased by 9.6% during the 1st semester 2021 compared to the same period in 2020. This development is supported by the new habits created by the sanitary crisis: extra room, home office, et cetera. It is nevertheless difficult to predict how long this positive situation will last.

FEP/GFA, October 2021

top

FEP reports that all in all the parquet market in Europe remained stable in 2020 despite the pandemic. As usual, the results show variations from country to country, also reflecting the evolution of the illness and the related governmental measures in the different member states.

FEP: “The good start of the year observed at the very beginning of 2020 had unfortunately to be balanced with the surge of the covid-19. During spring 2020, the situation got worse when going from north to south of Europe which was hit earlier and harder by the pandemic. Italy, Spain, but also France or Belgium have been locked down for weeks. Non-German speaking parts of Switzerland and Austria were also confronted to this kind of situation. On the other hand, the activity never really stopped in Germany and some shops, such as DIY, were open during the first wave. And no drastic confinement measures were taken in Scandinavia where life remained as normal as possible.”

“Austria, Sweden and Switzerland have totally compensated, during the second half of 2020, the bad performance observed in March-April. Still on the positive side, German market for parquet, the biggest one in Europe, has grown further, driven by renovation. On the other hand, despite a good summer and a good renovation rate, Italy, France and Spain have not been able to offset the loss experienced during the spring lockdown.”

Consumption in the FEP area remained flat in 2020 (-0.25%) and reached 81,741,530 m2 compared to 81,946,440 m2 the year before.

In terms of consumption per country, Germany keeps its first position with 20.47%. Sweden takes the second position (10.14%) before France at 9.94% and Italy at 9.37%. Austria with 8.10% keeps its fifth position while Switzerland (7.16%), the Nordic Cluster (7.14%) and Spain (6.80%) follow. As regards the per capita parquet consumption, Sweden keeps the first seat (0.80 m2) before Austria (0.74 m2), Estonia (0.73 m2) and Switzerland (0.68 m2). In the total FEP area, the consumption per inhabitant remains stable at 0.19 m2 in 2020.

The production in FEP territory remained stable in 2020 and exceeded the 76 million square meter threshold. The European production outside FEP countries is at an estimated 13.5 million square meters – 8.5 million square meters produced in EU countries and 5.0 million square meters in European non-EU countries.

The total production in FEP territory slightly increase (+0.59%) to a volume of 76,172,040 m2. Taking into account the total production in Europe (FEP countries + non-FEP countries in Europe) implies that production in 2020 declined slightly by 0.28% but exceeded 89 million m2.

The 2020 total parquet production per type remains similar to the picture already presented from 2010 onwards, whereby multilayer comes in first with 82% (compared to 83% in 2019), being followed by solid (including lamparquet) at a stable 16% and mosaic with 2% of the total cake (compared to 1% in 2019).

In absolute production figures by country, Poland maintains its top position at 16.29%. Sweden consolidates its second place on the podium with 15.87%. It is followed by Austria at 12.82%, while Germany comes in as fourth (9.86%).

The usage of wood species in 2020 indicates that the share of oak increases slightly and reaches 81.8% compared to 80.6% in 2019. Tropical wood species represent 3.0% of used wood. Ash and beech are still the two other most common chosen species with 5.6% and 2.8% (compared to 7.2% and 2.0% in 2019) respectively.

FEP’s outlook for 2021 and 2022 is as follows. The European parquet market has generally slowly started the year 2021 with stable to slightly increasing consumption in January and February. This positive trend accelerated in March and April, still driven by renovation. The provisional results for the first quarter 2021 indicate increasing parquet consumption (also compared to 2019, as 2020 was a very specific year with the surge of covid-19) in all countries but Spain. Germany and Italy report stable consumption levels during the two first months of the year but which were already rising in March and especially April.

FEP: “While there are uncertainties for the future regarding the continuous impacts of the pandemic, the restart of travels thanks to vaccines and the long-term economic consequences (recession, reduced public spending and decline in new projects), some habits have changed and this crisis also represents an opportunity for the Parquet industry, which has already well benefitted from the increase of the renovation rate and of its relatively higher use of wood. It seems that not only the European authorities have now understood the positive role played by wood and wood products to tackle climate change by saving CO2, but the end-consumers as well, bringing nature into their homes!”

FEP concludes: “These positive developments are nevertheless tempered by the issue of tight supplies of raw materials and their significantly increasing costs. This phenomenon does not only concern wood and wood-based products but also glues, lacquers, packaging, etc.”

|

Production and consumption developments 2020/2019. |

FEP/GFA, June 2021

top

European parquet markets are gaining momentum during spring, as reported by the European Federation of the Parquet industry (FEP), but are facing difficult raw materials supply conditions as well.

The European parquet markets in general started the year ‘slowly’ with stable to slightly increasing consumption in January and February. This positive trend is now accelerating in March and April, still driven by renovation, says FEP.

The market situation for the three first months of 2021 is here in most cases compared to the same period of 2019, as 2020 was a very specific year with the surge of the Covid-19. The provisional results for the first quarter indicate increasing parquet consumption in all countries but Spain. Germany and Italy are reporting stable consumption levels during the two first months of the year but which are already rising in March and especially April.

FEP: “These positive developments are nevertheless tempered by the issue of tight supplies of raw materials and their significantly increasing costs. This phenomenon does not only concern wood and wood-based products but also glues, lacquers, packaging, etc.”

A brief per country recap is provided below.

Austria

The Austrian parquet market is performing well (+10% for the 1st quarter 2021 compared to the same period in 2020), although there are worries regarding the shortages and increasing costs of all raw materials.

Baltic States

Baltic countries’ parquet markets rose by 3 to 5% during the first quarter of the current year.

Benelux

Parquet consumption on Benelux markets has increased by 3% compared to the 1st quarter 2019, and order books are full for the coming months.

France

Compared to the first three months of 2019, parquet consumption rose by 3 to 5% during the first quarter 2021. The French parquet market is stable to increasing despite tight supplies of raw materials, especially wood, which could hamper this positive evolution in the coming months.

Germany

January and February have been quiet months on the German parquet market due to the closure of DIY shops in most of the Landers. Nevertheless, the situation has improved in March and is now booming in April. Renovation is still driving the positive trend while, as throughout Europe and beyond, availability and costs of raw materials are an issue.

Italy

Italian consumption of parquet has been stable at the very beginning of 2021 and is now increasing in March-April. Forecasts from September to the end of the year are pretty optimistic thanks to construction and renovation activities. However, costs of raw materials are significantly rising.

Nordic cluster

The Norwegian parquet market continues to benefit from the high renovation rate while the Finnish market is catching up. All in all, the Nordic cluster is showing an increase by 3 to 5% for the first quarter 2021 compared to the same period in 2019.

Spain

The Spanish market for parquet slightly declined (-2%) during the first quarter of 2021 but is improving in April. Nevertheless, forecasts are not that optimistic and raw material is also here problematic with shortages and high costs.

Sweden

Parquet consumption increased by 3 to 5% during the first quarter 2021 compared to the first quarter 2019. Renovation is still supporting the Swedish market for parquet although raw materials costs are staggering and could have a negative impact in the future.

Switzerland

The long-awaited increase of the renovation rate and use of wood in renovation is now taking place, supporting the Swiss parquet market which rose by 3 to 5% during the three first months of 2021 and compared to the 1st quarter 2019. The question is whether this positive trend is sustainable in time. Issues of raw materials availability and costs concern specifically HDF and other wood-based panels.

FEP/GFA, April 2021

top

Despite ‘special’ circumstances in 2020, European Producers of Laminate Flooring members were able to grow their business by 2,74% in comparison to 2019, with 459.0 million m² of flooring sold.

EPLF: “Considering that the pandemic brought the flooring industry to a near standstill in spring, members managed to overcome the recess rather quickly as global sales picked up speed and developed very positively over the rest of the year.” Looking at the global markets, North America recorded the biggest increase in sales with 22,4% in comparison to 2019 and 49.1 million m² sold. The main driver for the major increase in sales in North America - and the general recovery of global sales figures - was most likely the popularity of renovation and DIY projects during the pandemic, according to EPLF.

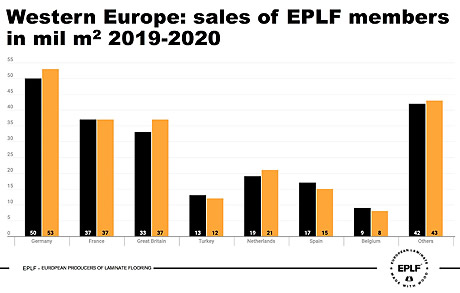

Another positive trend developed in Western Europe where total sales reached 225.7 million m² which represents an increase of 3,6% compared to 2019. As in the previous year, Germany remains the strongest market in Europe with sales of 52.7 million m² (+6,1% compared to 2019). Although both France and Great Britain sold 37.1 million m² of flooring, the growth rate in Great Britain (+13,7% compared to 2019) was much higher than in France (+1,6% compared to 2019). Similar to Great Britain, sales in the Netherlands increased by 13,8% to 21.1 million m² of flooring sold. The only major country in Western Europe which experienced a decrease in sales was Spain (14.6 million m² sold; -12,8%).

Sales in Eastern Europe remained stable in comparison to 2019 (-0,2%; 134.8 million m² sold). Russia, the biggest market of the region, continued to grow in 2020 with 46.2 million m² of flooring sold (+5,6% compared to 2019). Sales in Poland shrank by 6,6% (29.0 million m² sold) while the Ukraine was able to defend its place among the top three markets in Eastern Europe with a growth rate of 1,1% in comparison to the previous year (10.4 million m² sold). Sales in Romania shrank by 4,9% (9.6 million m² sold) while the market in Hungary grew by 11,7% (7.7 million m² sold).

In North America, 49.1 million m² of flooring were sold which represents an increase of 22,4% in comparison to 2019. The US market experienced a major growth of 28,1% compared to 2019 (38.1 million m² sold) while Canada recorded an increase in sales of 6,1% (11.0 million m² sold).

In all other regions, EPLF members reported decreases in sales. Asia recorded the greatest decrease in terms of percentages, followed by Latin America, Australia/Oceania and Africa.

|

EPLF/GFA, February 2021

top

The 2020 global sales figures of Multilayer Modular Flooring Association members show that wood products continue to grow with a global increase in sales of 18,82% and rigid SPC products maintain their market penetration across all major regions with a steady growth of 34,8%.

The growth of the ‘polymer’ product category however had been affected by COVID-19 as sales only revealed a modest rise of 3,1% at the end of the year. Overall, sales spiked in Q3 in an attempt to recuperate the setback during Q1 due to the early days of the pandemic and tax issues with the US, the MMFA reports.

In 2020, global sales of polymer products slightly increased by 3,1% in comparison to 2019 to 79.5 million m². The key driver for this positive end-of-year result were Rigid SPC products which continued to perform well in 2020 with 37.7 million m² sold (+34,8% compared to 2019). The other polymer categories had to face setbacks with 5.2 million m² sold of Rigid EPC flooring (-14,31% compared to 2019) and 36.7 million m² sold of LVT flooring (-15% compared to 2019).

The region with the greatest increase in polymer product sales was Eastern Europe which sold 4.9 million m² in 2020 (+23,9% in comparison to 2019). SPC products in the region experienced a sharp increase in sales of 153,3% (2.0 million m² sold) while sales of EPC (0.2 million m²; –19,3% compared to 2019) and LVT flooring products (2.7 million m²; –0,3% compared to 2019) both decreased. In Western Europe on the other hand, the polymer sector slightly declined by 6,6% in 2020 (37.5 million m² sold). As in Eastern Europe, SPC was the only product category which grew in 2020 (15.7 million m²; +28,8% compared to 2019). This positive result balanced the comparatively weak sales in the other product categories. EPC product sales (2.2 million m²) decreased by 13,0% while LVT product sales (19.6 million m² sold) experienced an even greater decrease of 22,9%.

Similar to Europe, the SPC category was the strongest of all polymer groups in North America with 19.2 million m² of flooring sold (+37,4% compared to 2019). The lower figures of EPC (2.5 million m²; –17,3% compared to 2019) and LVT products (13.4 million m²; +4,0% compared to 2019) led to a stable end-of-year result of 35.1 million m² of polymer flooring sold in North America in 2020 (+17,5% compared to 2019).

Latin America sold 0.3 million m² of polymer flooring which constitutes a decrease of 68,5%. In contrast to other regions, the SPC sector in Latin America faced setbacks of 22,2% compared to 2019 (0.2 million m² sold). Similar situations were observable in Africa where the sales for polymer flooring decreased by 44,5% (0.3 million m² sold) and in Asia which experienced a decrease of 21,4% (0.9 million m² sold). The region Australia / Oceania sold 0.4 million m² of polymer flooring (+9,5% compared to 2019).

Despite the impact of the pandemic, as the MMFA observes, the wood category performed well in 2020, with the exception of Latin America. The total sales of wood products reached 15.0 million m² in 2020, an increase of 18,82% compared to 2019. The region that recorded by far the greatest increase in sales is North America. With 0.1 million m², the sales more than doubled in 2020 (+171,1% compared to 2019).

With a growth rate of 21,8%, Eastern Europe (0.8 million m² sold) overtook the growth of Western Europe (14.0 million m²; +18,3% compared to 2019). Germany and Austria kept their positions as the countries with the highest sales in Western Europe. In Germany, 10.3 million m² were sold (+25,2% compared to 2019) while Austria recorded sales of 1.4 million m² (+9,2% compared to 2019). The same applies to the Czech Republic. As in the previous year, it was the country with the highest sales in Eastern Europe (0.4 million m²; +10% compared to 2019).

Asia only recorded a small increase in sales with 1,2% in comparison to 2019 (0.06 million m²). The only regions where the impact of COVID-19 resulted in a decrease of sales in the wood category were Latin America, Africa and Australia / Oceania.

|

MMFA/GFA, February 2021

top

Based on information obtained from its member companies and national associations, the European Federation of the Parquet industry (FEP) estimates that the overall consumption figures on the European parquet market managed to remain flat in 2020, led by renovation and the increased use of real wood flooring on the one hand and despite the pandemic on the other hand.

FEP underlines that this is a first prognosis subject to variations, in anticipation of the complete data to be communicated by FEP next June. A flat evolution is forecasted for the year as a whole, following a year 2019 which could still be characterized by a moderate growth.

As usual, the results show variations from country to country, also reflecting the evolution of the illness and the related governmental measures in the different member states, FEP says.

FEP: “Austria, Sweden, Switzerland, and, to a lesser extent, Spain, have totally, or partially, compensated, during the second half of the year, the bad performance observed in March-April. Still on the positive side, parquet consumption in Germany, the biggest European parquet market, has grown further also driven by renovation. On the other hand, despite a good summer and a good renovation rate, France and Italy have not been able to offset the loss experienced during the spring lockdown and report declines in parquet consumption.”

Despite uncertainties about the potential impacts of a third wave, about the restart of travels thanks to vaccines and the long-term economic consequences of the pandemic, FEP nevertheless regards the crisis as an opportunity for the parquet industry, which has already benefitted from the increase of the renovation rate and of its relatively higher use of wood flooring solutions. The Brussels based federation also stresses the positive perception of the role played by wood and wood products to tackle climate change by saving CO2.

Lastly, FEP’s 65th General Assembly and 45th Parquet Congress are postponed from June to 21 & 22 October 2021 in Athens, Greece.

GFA/FEP, January 2021

top